As the Pandemic Ends, Why Aren’t More People Going Back to Work?

Government interventions have changed the elasticity of wages, making it harder for firms to hire workers.

A quick drive around town these days provides all the evidence one might need of what economists call “tight” labor markets. Help wanted signs are everywhere, and starting wages are well above the current legislated minimums. One McDonald’s was even offering $50 to anyone who would just interview. Firms have openings and they are having big trouble filling them, especially in the service and hospitality industries. So what’s going on? Is this some sort of generalized failure of markets to pay sufficiently high wages, or is it the result of pandemic-related government interventions that have changed the incentives facing workers? I think it’s the latter, and to understand why, we don’t need much more than one of the most basic concepts in economics.

Price Elasticity

When we teach supply and demand, economists spend a good deal of time on the concept of “elasticity.” Elasticity in the general sense refers to the responsiveness of one variable to a change in another. Most often, we talk about “price elasticity,” which is the responsiveness of quantity demanded or supplied to a change in the price of the good in question. For example, if the price of beef rises, we know people will buy less of it, but how much less is the question of elasticity. If people will buy a lot less (more specifically, if the absolute value of the percentage change in quantity demanded divided by the percentage change in price is greater than one), we refer to the demand as “elastic.” If they will only buy a little less (the absolute value is less than one), we refer to that as “inelastic.” The same goes with supply. How suppliers react to a change in the price of the good they are selling can be categorized the same way.

Understanding elasticity is important for a variety of reasons. On the demand side, it helps firms try to discover the effect on their total revenues of changing the price of their good. For example, if they raise their price and demand is inelastic, only a few demanders will be unwilling to continue buying it, while many others will keep doing so, and the result will be an increase in total revenue. Lowering the price of an inelastic good reduces total revenue, because it doesn’t draw in many new buyers, as the definition of inelasticity is a lack of responsiveness to price changes.

This is also important in understanding why certain goods tend to be taxed, such as gasoline, alcohol, and cigarettes. One of the factors that makes goods inelastically demanded is that they have few real substitutes, while elastically demanded ones have more. Consumers will react more strongly to a change in the price of apples, given all of the substitutes, than they will to a change in the price of gasoline, which has few. The demand for each of gasoline, alcohol, and cigarettes is inelastic, so when the price goes up due to taxes, it doesn’t reduce the quantity demanded very much, and total revenue increases, which means more tax revenue for governments. That makes them popular items to tax. Elasticity also matters for understanding who bears the burden of the tax. The more inelastic the demand, the more of the tax will be passed on to consumers rather than born by producers, all else equal.

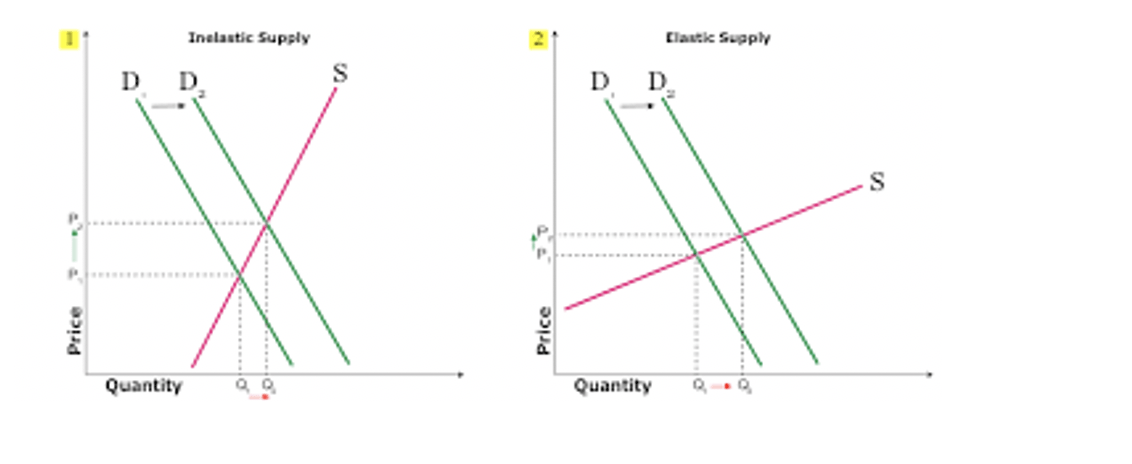

The elasticity of either supply or demand also helps to determine the effects of a change from the other side of the market. If we want to know the effects of a particular change in demand on the market-clearing price and the quantity of the good that is being exchanged, we need to know the elasticity of supply. The more that suppliers react to price, the smaller change in price is needed to call forth a significant increase in quantity supplied. If suppliers don’t react much to price changes, the result of a given change in demand will be a larger change in price and a smaller change in quantity supplied.

Understanding the Current Labor Market

So how does all of this relate to the current tight labor market? The answer is that two policy decisions made during the pandemic have dramatically increased the inelasticity of the supply of labor. A more inelastic labor supply means that workers are not as responsive to changes in wages. Any given change in wages gets fewer additional workers to join the labor force or work more hours. Why are workers less willing to work for higher wages than previously?

The first reason is probably the most obvious: the generous unemployment benefits and multiple rounds of stimulus payments have meant that workers can do better, or at least close to as well, by not working as they can by working. This will be especially true in the entry level jobs in the service and hospitality industries that appear to be having the most difficulties finding workers. If you can make more staying at home, why take a job? And even if you can’t make more, is it really worth working dozens of hours a week to do just a little bit better than you could get from not working? Compensating workers who were denied the opportunity to make a living thanks to government lockdowns might well have been justified earlier on in the pandemic, but continuing to provide that support after more than a year has unsurprisingly led to withdrawal from the labor force and a more inelastic labor supply.

The second reason is less discussed. Another policy decision with huge implications for the labor market was the closing of public schools, many of which remain closed to one degree or another. With children at home all day, many couples had to withdraw their secondary earner from the paid labor force. As most secondary earners are women, the labor market effect has mostly been a reduction in the number of working women. The effects of that reduction on women’s human capital and future wages may well turn out to be a major long-term negative consequence of the pandemic. But for the moment, this need to be home has also increased the inelasticity of the labor supply curve. The (mostly) women in this position are not likely to be enticed back to work with higher wages until the schools are fully open and the need for a parent at home is substantially reduced. Almost no matter how hard employers try, overcoming the opportunity cost of working (i.e., leaving kids home alone all day) is going to be very difficult.

As you can see in these basic supply and demand graphs, a more inelastic supply curve will mean that a given change in demand will generate a smaller increase in the market-clearing quantity than will the more elastic curve on the right. And the more inelastic curve will push price (wages, in the labor market) up higher than would be the case with a more elastic supply curve. What the pandemic policies have done is move us away from something more like the supply curve on the right to something more like the one on the left. Those policies have made workers less responsive to changes in demand, leading to the difficulties firms have faced in filling jobs.

Some additional evidence for this story is that the teenage job market is starting to recover. Most teenagers did not get unemployment or stimulus checks, nor do they have children of their own in school. Not only that, if they are not attending physical school or engaged in sports or extra-curricular activities, they have more time on their hands, and a good deal of flexibility about that time. All of these factors make their labor supply more elastic than that of many adults, making them more likely to respond to the increase in wages coming from higher labor demand.

The tightness of the current labor market is not evidence of some general inability of markets or employers to provide high enough wages. Rather it is the very predictable unintended consequence of pandemic-related government interventions that changed the choices facing a large number of potential workers, making the labor supply curve more inelastic. As the economy has come back to life and the demand for labor has increased, the more inelastic labor supply curve means that, compared to what the supply curve would look like without the pandemic policies, fewer additional hours will be worked, and getting even those hours will require a higher wage. Many fast-food franchisees report that they aren’t opening their dining rooms and are reducing hours because they cannot staff their businesses sufficiently. Managers are working multiple shifts and employees are going without days off to keep those businesses open. The result is a reduction in consumer well-being.

In the absence of generous unemployment benefits and the stimulus, and with schools open, the more elastic labor supply curve would mean that more workers would respond more quickly to the increase in demand, filling more jobs than is the case now, without firms having to pay as much to attract that labor. As the pandemic continues to ease, putting limits on unemployment benefits and avoiding additional stimulus payments, as well as getting schools fully open by the fall, will reduce the labor market tightness. That will enable firms to fill job openings at wages that will make it possible for them to provide their full range of products and services to the benefit of consumers.

The current state of US labor markets is an excellent example of how the basic tools of economics can help us understand what’s happening in the world and pinpoint the ways in which poor policy choices can cause undesirable unintended consequences. The ability to engage in this sort of analysis is a reason why a basic economics education is so important for an informed and engaged citizenry, and for understanding the dangers of so many well-intentioned government interventions.